- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is very important to be understood for these working within the financial sector. It is a process by which dirty cash is transformed into clean money. The sources of the money in precise are criminal and the cash is invested in a approach that makes it appear to be clear money and hide the identity of the prison a part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new prospects or sustaining current prospects the responsibility of adopting sufficient measures lie on every one who is a part of the organization. The identification of such aspect at first is easy to deal with as an alternative realizing and encountering such conditions afterward in the transaction stage. The central bank in any country supplies full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such situations.

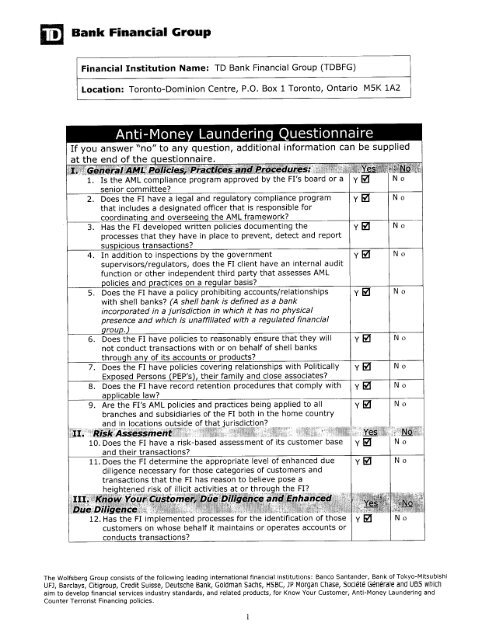

What Do You Need to Do. Anti-Money Laundering Questionnaire If you answer no to any question additional information can be supplied at the end of the questionnaire.

Study Solution And Tutorial Money Laundering Test Questions

Our CAMS study material helps you to pass the test on your first attempt.

Anti money laundering questions and answers pdf. I have dealt with my clients for many years do I still need to carry out Customer Due Diligence. Questionnaire on Anti-money Laundering and Counter-terrorist Financing Compliance of Accounting Professionals 2020 Frequently Asked Questions and Explanatory Notes FREQUENTLY ASKED QUESTIONS A. Compliance requirement of host and charting countries Correct Answer.

What is Terrorist Financing. Economic distortion and instability. Why is Anti-Money Laundering and 13 Counter-Terrorist Financing Important to You.

An anti-money laundering compliance program internal audit program and procedure manual D. Lowered reputational risk for the country. Verification or follow up of the answers and documents provided remains the responsibility of the firm using this questionnaire.

BCD QUESTION 5 Which two factors assist a money laundering investigation that involves multiple countries. CAMS Verified Answers We are a team of experienced professionals. Questions and Answers.

The potential macroeconomic consequences of unchecked money laundering include. Increased Exposure to Organized Crime. A few team members have worked on.

Examples of different forms of money laundering involving the FIs products and services. We offer end-to-end anti-money laundering sanctions and. What is Money Laundering.

Questions and Answers in order to promote the sound effective and consistent application of rules on anti-money laundering and terrorist financing to investment-based crowdfunding platforms. If the answer to question 27 is Yes does the FI provide AML training to relevant third parties that includes. Identification and reporting of transactions that must be reported to.

Which three of the following are the likely effects of money laundering. We update our questions frequently. So the Certified Anti-Money Laundering Specialists Exam candidates always get the latest CAMS questions.

Appendix A - Anti-Money Laundering Questionnaire Each National Futures Association NFA futures commission merchant FCM and introducing broker IB Member firm must adopt a written anti-money laundering. Anti-Money Laundering and Countering Financing of Terrorism AMLCFT An official website of the European Union An official EU website How do you know. At a recent seminar organised by the Responsible Art Market Initiative RAM a panel of experts answered questions from the floor about the new law.

The purpose of this document is to promote common supervisory approaches and practices in the application of anti-money laundering rules to. About the AML Questionnaire 1. Anti money laundering test questions and answers pdf.

Anti-Money Laundering Quiz questions Money laundering is the act of failing to disclose money got by criminal means and passing it off as legitimate money. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations PDF Joint SAR FAQs Final 508pdf 23203 KB. Increased risks to privatization efforts.

New rules relating to anti-money laundering law now apply in the UK. Who needs to perform Anti-Money Laundering checks. We add the CAMS quizzes for the latest CAMS certifications.

Generally money launderers tend to seek out countries or sectors in which there is a low risk of detection due to weak or ineffective anti-money laundering programs. There are three stages involved in money laundering. CertsQuestions are also providing detailed Acams CAMS pdf exam question answers that will help you prepare for the real exam.

The triggering event that led to the passing of the USA Patriot Act and Title III of the act was _____. All official European Union website addresses are in the europaeu domain. Placement layering and integration.

The creation of. 250 Anti Money Laundering Interview Questions and Answers Question1. The discovery of gaps in existing anti-money laundering laws.

Seven key questions answered. Detailed Association of Certified Anti Money Laundering CAMS PDF Exam Questions Answers. Guidance on answering specific questions in the AML Questionnaire C.

Please describe your Institutions Know-Your-Customer KYC policies. If you are using CAMS dumps pdf questions sheet then you will be able to clear your lost concepts. About the AML Questionnaire B.

The Role of the Narcotics Division and 21 the Joint Financial Intelligence Unit. General AML Policies Practices and Procedures. What is Money Laundering.

Because the objective of money laundering is to get the illegal funds back to the individual who generated them launderers usually prefer to move funds through stable financial systems. Why do I need to perform Anti-Money Laundering checks. Provide information on account opening procedures documentation requirements and record retention policies the identification of beneficial owners and the acceptance of high.

Bank of Commerce AML Questionnaire Page 4 of 5 E. 1 Anti-Money Laundering Sanctions Anti-Corruption Solutions FTI CONSULTING FTI CONSULTING Anti-Money Laundering Sanctions Anti-Corruption Solutions 1 FTI Consulting is well positioned to assist you with all aspects of your organizations compliance risk management and investigations efforts. Anti-Money Laundering Control 1.

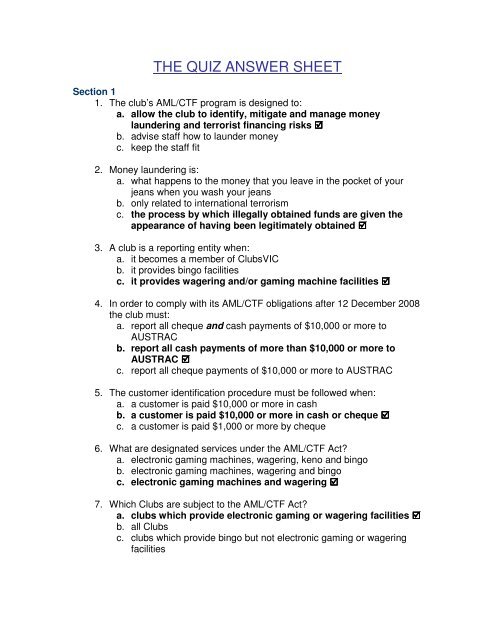

The Quiz Answer Sheet Pdf Free Download

Aml Kyc Mcq Money Laundering Financial Action Task Force On Money Laundering

The Quiz Answer Sheet Pdf Free Download

Anti Money Laundering Key Pdf Money Laundering Banks

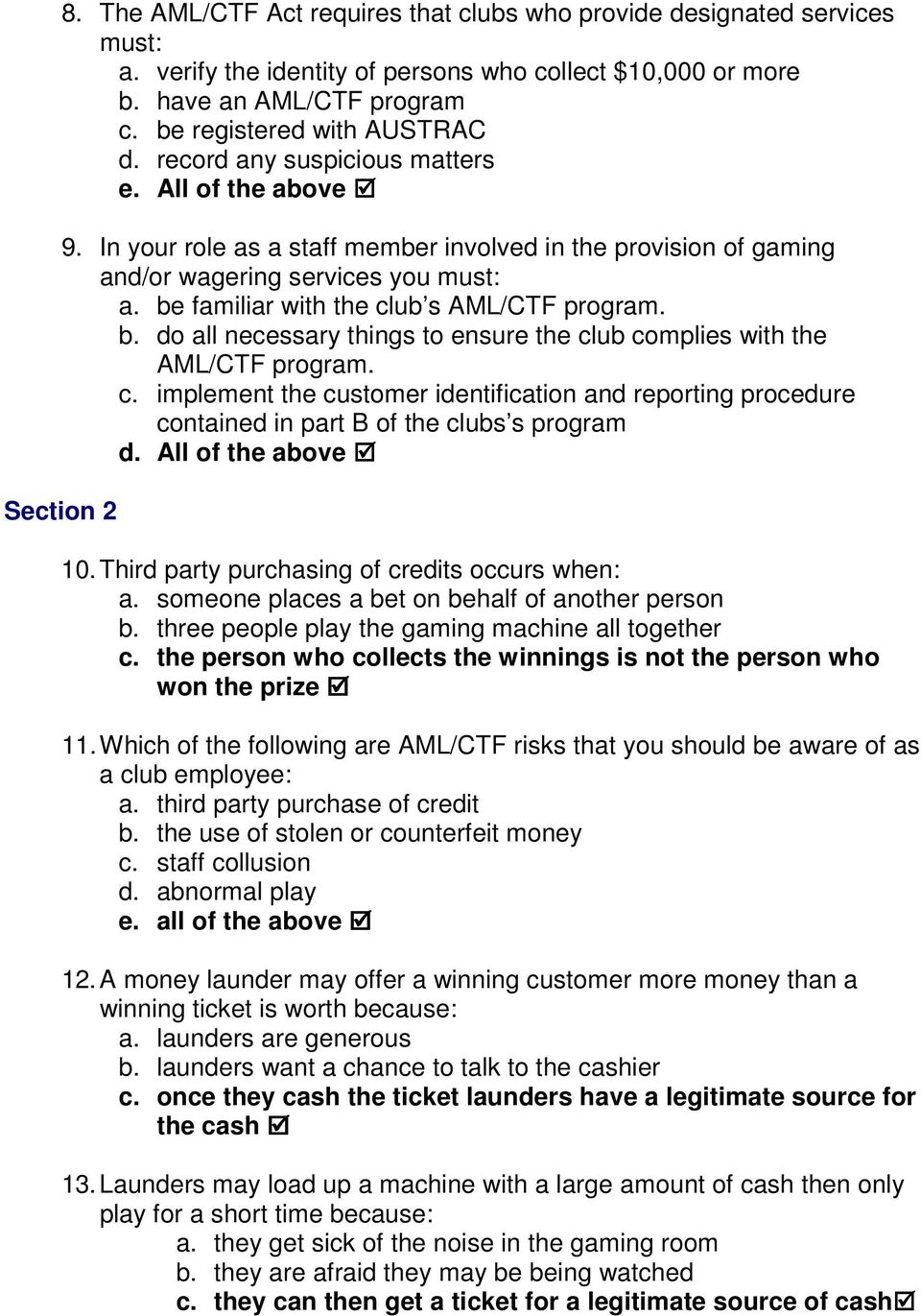

Module 1 Fundamentals Of Aml Ctf Programs Questions And Answers Question 1 Module 1 Quiz With Answers Pdf Free Download

Anti Money Laundering Key Pdf Money Laundering Banks

Anti Money Laundering Questionnaire Pdf Free Download

Module 1 Fundamentals Of Aml Ctf Programs Questions And Answers Question 1 Module 1 Quiz With Answers Pdf Free Download

The Quiz Answer Sheet Pdf Free Download

Module 1 Fundamentals Of Aml Ctf Programs Questions And Answers Question 1 Module 1 Quiz With Answers Pdf Free Download

Anti Money Laundering Questionnaire Td Securities

The world of rules can look like a bowl of alphabet soup at instances. US cash laundering regulations are no exception. We've compiled a listing of the top ten money laundering acronyms and their definitions. TMP Danger is consulting agency centered on protecting monetary companies by decreasing danger, fraud and losses. We have now huge financial institution expertise in operational and regulatory threat. We've got a powerful background in program administration, regulatory and operational danger as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many antagonistic penalties to the organization due to the dangers it presents. It will increase the chance of major risks and the chance value of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment